Wizely Makes Digital Gold Investment Easy and Secure

Jul 23, 2025

NewsVoir

Pune (Maharashtra) [India], July 23: Investing in digital gold has emerged as a modern, secure, and flexible way for individuals to grow their wealth. Unlike traditional gold, which requires physical storage and raises security concerns, digital gold offers a safer alternative. One can buy and hold pure 24K gold online, backed by real assets stored in insured vaults.

It is especially suited for those wanting to invest small amounts regularly. Digital gold apps also let investors check live market trends and ensure liquidity without worrying about safety. Platforms like Wizely make the entire experience even more seamless, combining ease of use with high levels of security and transparency.

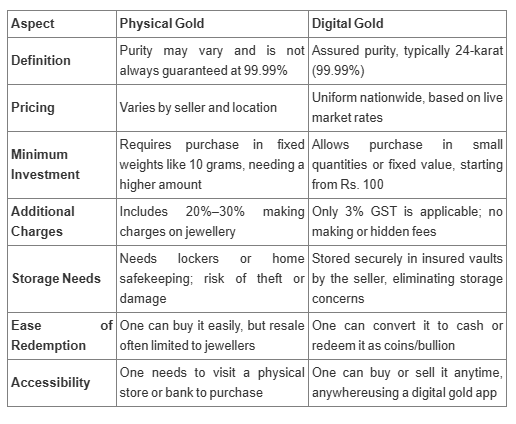

Physical Gold vs Digital Gold

Choosing between physical gold and digital gold depends on factors like convenience, cost, and security. While both serve as valuable assets, their features differ significantly. The table below highlights the key differences to help make an informed decision.

Why Choose Digital Gold?

Digital gold combines the timeless value of gold with the ease and efficiency of technology. It offers a smart, secure, and flexible way to save and grow wealth in today's fast-paced world. Here are a few key benefits investors can consider:

* Acts as a stable safety net during market downturns

* Offers quick access to funds in emergencies through easy liquidation

* Combines traditional gold value with modern, secure technology

* Eliminates making charges and locker fees associated with physical gold

* Stored safely in insured vaults at no additional cost

* Enables low-cost, fractional investing starting from minimal amounts

* Ideal for beginners and those building wealth gradually or without a large corpus

* Eliminates concerns related to physical storage, theft, or loss

* Simplifies gifting by allowing digital transfers for any occasion

* Recipients can hold or convert the gold as preferred

* Preserves the cultural value of gold in a modern format

Taxation on Digital Gold

Taxation on digital gold applies in the same manner as physical gold. While offering a modern and convenient way to invest, gold investment is subject to capital gains tax. The holding period directly impacts tax liability and overall returns.

When investors hold digital gold for 24 months or more, it is treated as a long-term capital asset. In this case, a tax rate of 12.5% is applicable with a cess. If sold before 36 months, the gains are considered short-term, and tax is applicable as per the investor's income tax slab.

Getting Started with Digital Gold Investment on Wizely

To invest in digital gold with Wizely, investors can download the app from the Google Play Store or Apple App Store. The following steps outline the process:

1. Enter a mobile number and email address, then verify through OTP

2. Set a secure 4-digit PIN to protect access

3. Provide the full name as per PAN card records

4. On the home screen, select the 'Buy Gold' option

5. Choose the investment amount, starting from Rs. 100

6. Complete KYC by entering the PAN number

7. Make the payment; the gold rate remains fixed for 7 minutes during this step

This straightforward process enables investors to safely and efficiently start investing in digital gold through the Wizely platform.

Buying digital gold is a smart and accessible way to grow wealth. It removes the limitations of traditional investment methods. On the WizelyApp, users can experience a seamless platform to start investing in gold from just Rs. 100. It offers real-time pricing and secure, insured storage.

Whether saving for long-term goals or building a saving habit, investing in digital gold through Wizely fits both new and experienced investors. With complete transparency and flexibility, it puts control and confidence in the hands of the user. Investors can download the WizelyApp today and take the next step in their digital gold investment journey.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)